Another life I imagine might be some sort of a financial planner. Clearly I like to play with numbers, and review personal finance books (e.g., illustrating compound interest and the cost of current gratification, or explaining stocks and bonds). While I'd like further education, I already have some competence with finance, following this advice:

- Simplify by donating or selling unneeded items.

- Maintain a used car as long as possible (e.g., by minimizing driving).

- Have no debt--in fact, through budgeting save an emergency fund for one year's expenses.

- Save and research for major purchases (including SIFF and travel).

- Pay bills online automatically.

- Almost always pay the full balance on credit cards selected for their features.

- Regularly review three free credit reports.

- Contribute to an (Roth or traditional) IRA.

- Use savings to defer income in order to start a business.

- Research and purchase auto, dental, disability, liability, life, medical, renter's, and vision insurance, combining when possible.

- Have an estate plan.

- Set up a 401(k) and fully fund it.

- Periodically review asset allocation.

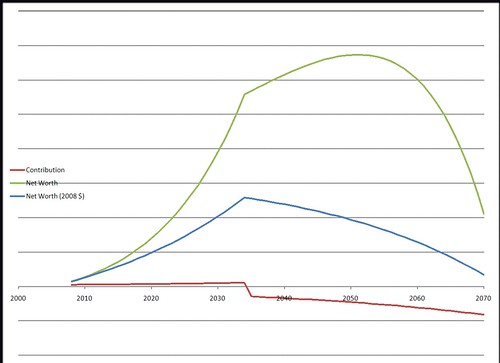

- Have written goals and milestones for net worth and retirement.

[Corrected wording.]